Zeige Detail-News an

As of 2025 e-invoicing will be mandatory in Germany: 5 facts that companies need to know now

Many companies already work with electronic invoices - they will become mandatory as of 2025. There are to be transitional regulations, however there will be no real exceptions. What can companies expect? How can they prepare? We have compiled the most important facts and tips for you.

Paper invoices, PDF invoices or electronic invoices - there is still a free choice of which invoice formats can be used in business transactions. As of 2025, this is set to change radically with the mandatory introduction of electronic invoices in the B2B (business-to-business) sector. More specifically, this means that companies will be able to receive electronic invoices as of 2025 and will also have to create and send them themselves as of 2026. All companies subject to VAT in Germany will be affected. For example, if a supplier decides to only send electronic invoices from January 1, 2025, invoice recipients and their software must be prepared for this.

What is an electronic invoice exactly?

If you're already thinking, problem solved, I've been sending my invoices to my customers by e-mail for a long time - far from it! With an e-invoice, the invoice data is not sent to the recipient as a PDF attachment, but as a structured data record. Visually, this data record resembles an HTML page on the Internet. The invoice recipient can only read and process the data, such as the input VAT, with the appropriate accounting software. Companies that process many orders with the public sector are already familiar with this. They upload their e-invoices to corresponding portals.

What transitional regulations are planned?

It is still only a draft law, but it is highly likely that the plans of the Federal Ministry of Finance (BMF) will be implemented in the following stages:

- From 01.01.2025: E-invoices can be sent by all companies. Paper invoices are permitted until 31.12.2025, while other electronic formats (PDF etc.) may only be sent with the recipient's consent.

- From 01.01.2026: Companies with a previous year's turnover of over EUR 800 thousand must use e-invoices. Companies with a previous year's turnover of less than EUR 800 thousand can use conventional invoice formats (paper, PDF, etc.) until 31.12.2026.

- From 01.01.2027: All companies in the B2B sector must use e-invoices.

- From 01.01.2028: Introduction of a declaration system in which a transaction-related VAT declaration (invoice statement) must be transmitted to a standardized administration system for each invoice. This declaration will comply with the EU requirements for cross-border transactions (intra-Community supplies and services) in accordance with ViDA (VAT in the Digital Age, ViDA for short).

Electronic invoices should make it easier for tax authorities to combat VAT fraud in future.

Electronic invoices should make it easier for tax authorities to combat VAT fraud in future.Does the changeover only affect larger companies?

No, although there is currently no legal obligation for e-invoices in the B2B and B2C (business-to-customer) sectors, the changeover from paper to pixels will come for the B2B sector.

What does the business community say about mandatory e-invoicing?

Pro: Less VAT fraud

The electronic invoice, coupled with a subsequent declaration system to the tax authorities, is primarily intended to facilitate the fight against VAT fraud. Leading trade associations welcome this. What's more, e-invoicing is seen as the key to digitalization. In this respect, Germany is lagging far behind other countries such as Italy or France, where digital invoices have been standard for years.

Contra: Introduction too premature

Criticism is voiced in particular by small and medium-sized businesses. Many of them have had bitter experiences in recent years with the demanding and costly requirements for electronic cash registers and therefore fear something similar in connection with the e-invoicing requirement. The business community also sees a need for improvement and considers the introduction to be too premature in already difficult times of crisis. The reasons for this are problems at the tax offices, the limited functionality of the government platform for transmitting electronic invoices and possible bottlenecks at IT service providers.

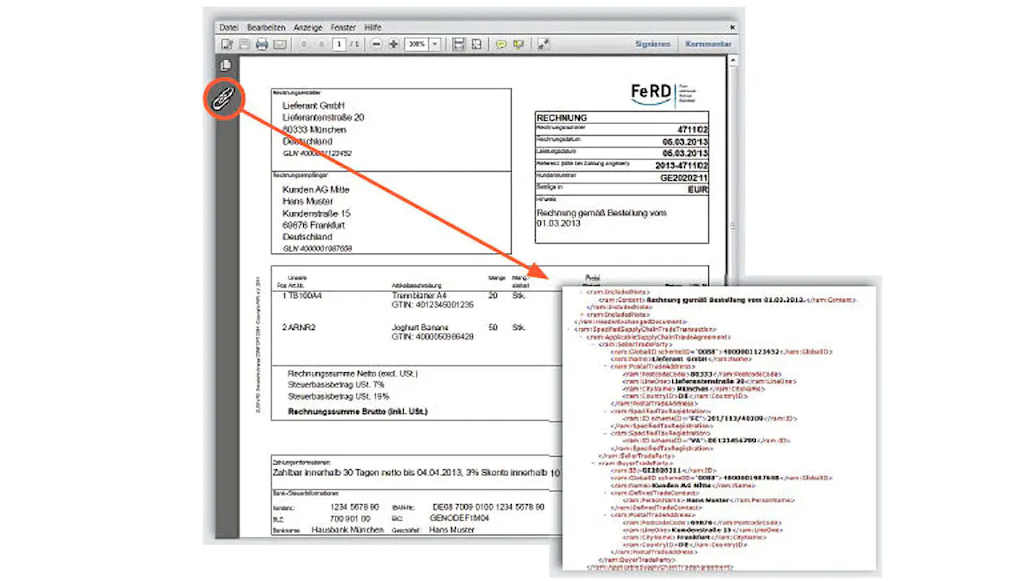

Challenge: legibility of the e-invoice

The legislator defines an e-invoice as an invoice that complies with the European standard EN 16931. The ZUGFeRD 2.x and XRechnung formats used in the DATEV applications already comply with the EN 16931 standard. Anyone who does not work with DATEV in the area of accounting therefore needs software solutions that can create e-invoices and make them legible. This is one reason why the trade sector is proposing hybrid invoice formats that can be read and changed as usual and meet the requirements of an e-invoice.

E-invoices require special software for machine-readable data records, such as "ZUGFeRD" files or "XRechnungen".

E-invoices require special software for machine-readable data records, such as "ZUGFeRD" files or "XRechnungen".

How can you prepare?

#Tip 1: Don't leave it to the last minute

"My recommendation is to set the course for the digitalization of invoicing processes as quickly as possible and not leave it to the last minute," says tax consultant Thomas Langer. This is because the digitalization of invoicing processes cannot just be implemented overnight. It requires a certain amount of time and money as internal processes, software and IT systems need to be adapted.

Tax consultant Thomas Langer: "Digitise invoice processes now - for receiving and sending e-invoices."

Tax consultant Thomas Langer: "Digitise invoice processes now - for receiving and sending e-invoices."#Tip 2: E-invoices with DATEV

Clients can take additional precautions by checking whether the software they use for invoicing and accounting also offers an e-invoicing function. If DATEV UNTERNEHMEN ONLINE is in use, e-invoices can be easily received, read, processed and archived in the future. DATEV SMART TRANSFER enables e-invoices to be generated and sent in almost any e-invoice format, for example from a DATEV invoicing program or from third-party software.

#Tip 3: Utilize digital potential

Switching to electronic invoices fundamentally simplifies work between the company and the tax consultant and offers many advantages: Documents can be processed digitally and directly by the tax consultant. The account assignment workload is reduced. Business evaluations will be possible almost in real time and business decisions will always be based on this up-to-date data.

As a tax consultancy office, we are already actively implementing measures to ensure that our clients are optimally prepared for the introduction of e-invoicing. Please get in touch with us if you would like to find out more about the steps that need to be taken.

Image sources: Adobe (momius, leszekglasner), FeRD.net